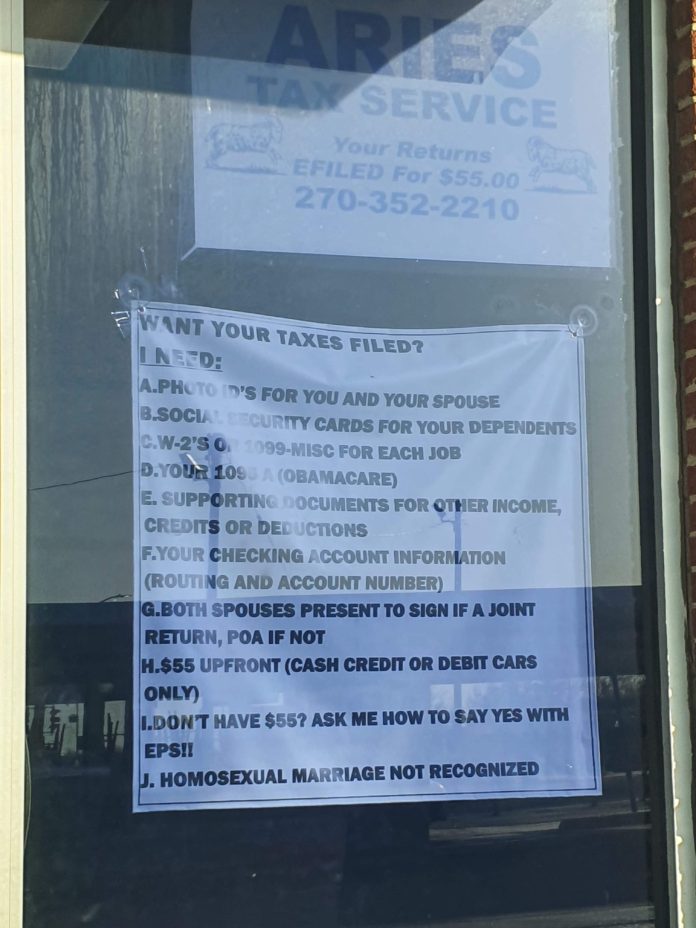

On a window outside Aries Tax Service in Radcliff, Kentucky, signs promote how customers can e-file returns for $55 as long as they provide 10 things to Ken Randall, the registered tax return preparer at the Hardin County business.

The alphabetized list includes documents, forms and information they need to provide when they complete their taxes.

But the last thing Randall lists on his “I Need” placard is something he doesn’t want:

“Homosexual marriage not recognized,” the bottom of the sign reads.

Seeing that statement left Amy Mudd and her wife “feeling hurt and discriminated against,” the Glasgow woman told The Courier Journal.

Mudd said her mother-in-law live in Hardin County and recommended Randall’s business because of the flat fee of $55.

After talking with Randall over the phone and setting up an appointment, Mudd and her wife of five years, Stephanie, drove a little over an hour from Glasgow to Radcliff on April 3, but they never stepped inside the office.

When they pulled into the parking lot and noticed the “homosexual marriage not recognized” portion of the sign on the window, Stephanie took a photo and drove away.

“We are NOT doing any business here,” Mudd said her wife angrily declared.

“We have a wonderful family, and to be shamed because of who I love is awful,” Mudd told The Courier Journal in an email, adding she and her wife have twin daughters, four dogs and a cat.

“It’s 2021 and I’ve never understood why discrimination is a thing,” Mudd continued, saying she and her wife eventually went to their regular tax preparer in Brandenburg after not taking up the $55 deal at Aries Tax Ser. “Black, Asian, Muslim, LGBTQ+, etc. We are all human.”

Randall, 65, told The Courier Journal in an email he has “moral objections to homosexual marriage.”

“I have filed and do file for homosexuals who are single, as I do not ask about sexual preference prior to filing a return,” Randall said, adding “this is legal, as I have already researched this.”

In the same building as his tax service, Randall also runs and serves as a broker for The Insurance Store, which is “The Place To Go When You’re Told No,” according to its website.

More:Kentucky extends state tax filing deadline to May 17, mirroring federal deadline

Radcliff and Hardin County are not among the 21 municipalities and counties in Kentucky that have passed Fairness Ordinances outlawing discrimination against lesbian, gay, bisexual, transgender and queer residents.

In 1999, Louisville and Lexington became the first two cities in the state to each pass a Fairness Ordinance extending LGBTQ protections.

Crescent Springs, a city in Northern Kentucky’s Kenton County, became the latest municipality to pass a Fairness Ordinance in March, per the Fairness Campaign, a Louisville-based LGBTQ advocacy group.

Repeated attempts to pass a statewide “fairness bill” have failed in the Kentucky General Assembly, which currently features a Republican supermajority.

Chris Hartman, executive director of the Fairness Campaign, said while last year’s Bostock v. Clayton County ruling from the U.S. Supreme Court protects gay and transgender employees from discrimination, Kentucky’s civil rights statute does not ban sex discrimination for public accommodations.

The only exception outlawing sex discrimination under state law is for businesses “supported directly or indirectly by government funds.”

That means Randall and Aries Tax Service legally can deny services to gay couples such as Amy and Stephanie Mudd, according to Hartman.

Roughly 144,000 residents who are 13 years of age and older are part of the LGBTQ community in Kentucky, and LGBTQ adults make up roughly 3.4% of the state’s population, according to the Movement Advancement Project, a nonprofit think tank.

The incident in Radcliff is not the first of a tax prep business denying services to gay couples.

A tax preparer in Russiaville, Indiana, made local and national headlines in 2019 when she refused to help a married couple who was gay, citing her religious beliefs and recommending a different tax service business.

What every Kentuckian should know:From unemployment to new deadlines, here are recent tax changes

That decision was allowed under a Religious Freedom Restoration Act that then-Indiana Gov. Mike Pence signed in 2015, though lawmakers had amended the legislation to try to assuage fears it would allow businesses to discriminate against LGBTQ customers.

Kentucky’s Religious Freedom Restoration Act, which took effect in 2013, says the government “shall not substantially burden a person’s freedom of religion” unless the state has “clear and compelling evidence” to step in and uses the “least restrictive means” to do so.

Hartman said in any case, Randall’s stated opposition to helping gay customers file their taxes is “rude.”

“It’s discriminatory. It’s disgraceful,” Hartman said. “And it’s a downright shame.”

As for Randall, an Army veteran who has been a tax preparer for 20 years and an insurance broker for 33 years, he said a woman “took exception to my policy a couple years ago.”

His response?

“This is where you find out that tolerance is a two-way street.”

Reach Billy Kobin at bkobin@courierjournal.com.