Good morning,

It’s Zaheer here.

Who’s laughing now?

The world’s strangest (and cutest) cryptocurrency

In January 2014, the two-man Jamaican bobsled team announced they wouldn’t be able to make it to the Winter Olympics in Sochi as they didn’t have the $80,000 needed for travel, equipment and other expenses.

They ended receiving help from an unusual source (yes, even more unusual than ice-racers from the tropics). Users of Dogecoin, a cryptocurrency that began as a joke, helped make Olympics history by raising more than $30,000 worth of Dogecoin to help fund the team’s trip to Russia.

A Doge is born

Source: Dogecoin Facebook

Dogecoin had been created the previous year by Jackson Palmer, a product manager for Adobe Inc in Sydney, and Billy Markus, a software developer at IBM, as a joke about the hype surrounding

With Shiba Inu (a Japanese hunting dog and early meme celebrity) as its logo, Palmer and Markus promoted Dogecoin as a less serious alternative to Bitcoin that would also be faster, and more adaptable and consumer-friendly.

- Pronunciation check: Though it is variously pronounced as “doggie”, “doh-gay”, “dog-ay”, or just “dog”, the correct pronunciation according to Markus is “dohj” coin.

Dogecoin is an inflationary coin, meaning there’s no limit on its supply. This is a feature it shares with fiat currencies and one that makes it unlike Bitcoin and most other cryptocurrencies, which have a ceiling on the number of coins that will be created.

Underneath all the “such wow”, “how money” hilarity, Dogecoin’s underlying technology is borrowed from Litecoin, a legitimate bitcoin spinoff that was launched in October 2011. With a market value of over $42 billion at current prices, Dogecoin is now the world’s 7th largest cryptocurrency.

Source: Giphy

First roller coaster: In December 2013, the value of Dogecoin jumped nearly 300% in three days (from $0.00026 to $0.00095). This was around the time that China barred its banks from investing in crypto, leaving Bitcoin and other cryptocurrencies reeling.

Three days later, Dogecoin saw its first major crash when its value dropped by 80% because of China’s decision and other factors.

First scam: In March 2014, Alex Green, aka Ryan Kennedy, a British citizen created a Dogecoin exchange called Moolah and convinced users of the cryptocurrency to donate large sums to fund it. It helped that Green was known as a generous tipper in the community, and that he once accidentally donated $15,000 instead of $1,500 to sponsor a NASCAR driver.

It was revealed later that Green used the moolah not on Moolah (sorry) but to buy more than $1.5 million of Bitcoin. Inevitably, he used proceeds from that investment on the sort of cartoon villain lifestyle you’d expect. Two years later, he was convicted of multiple counts of rape and sentenced to 11 years in prison.

First hack: On December 25, 2013, hackers stole millions of Dogecoins from the wallet platform Dogewallet. They modified its web page in a way that transactions weren’t sent to their intended recipients but to a single account. But because of the minuscule value of each coin, the loot totalled just $12,000.

Nonetheless, the Dogecoin community started an initiative called “SaveDogemas” to donate coins to those who lost funds in the breach.

The Dogefather

Source: Giphy

Dogecoin has had an incredible run since the start of 2021. If you had invested $1,000 in it on January 1, you would be sitting on a few tens of thousands of dollars now.

That’s largely to do with the fact that Dogecoin has some heavyweight celebrity backers, including Tesla CEO Elon Musk, fellow billionaire Mark Cuban, and rapper Snoop Dogg.

In January, Dogecoin’s price went up over 800% in 24 hours, hitting $0.07 after attention from Reddit users looking to turn it into the crypto version of GameStop.

Musk has called Dogecoin his “fav” cryptocurrency and “the people’s crypto” on Twitter, and at the start of April vowed to “put a literal Dogecoin on the literal moon”. Each tweet saw the price of Dogecoin jump a few percentage points.

The latest of Musk’s Doge tweets came earlier this week, when he slipped in a reference to the cryptocurrency while confirming his upcoming appearance on Saturday Night Live, causing its value to jump 20%.

Let me now pass it on to Vikas SN for other big developments of the week

INCOMING: INDIA’S FIRST TECH UNICORN IPO & A MEGA

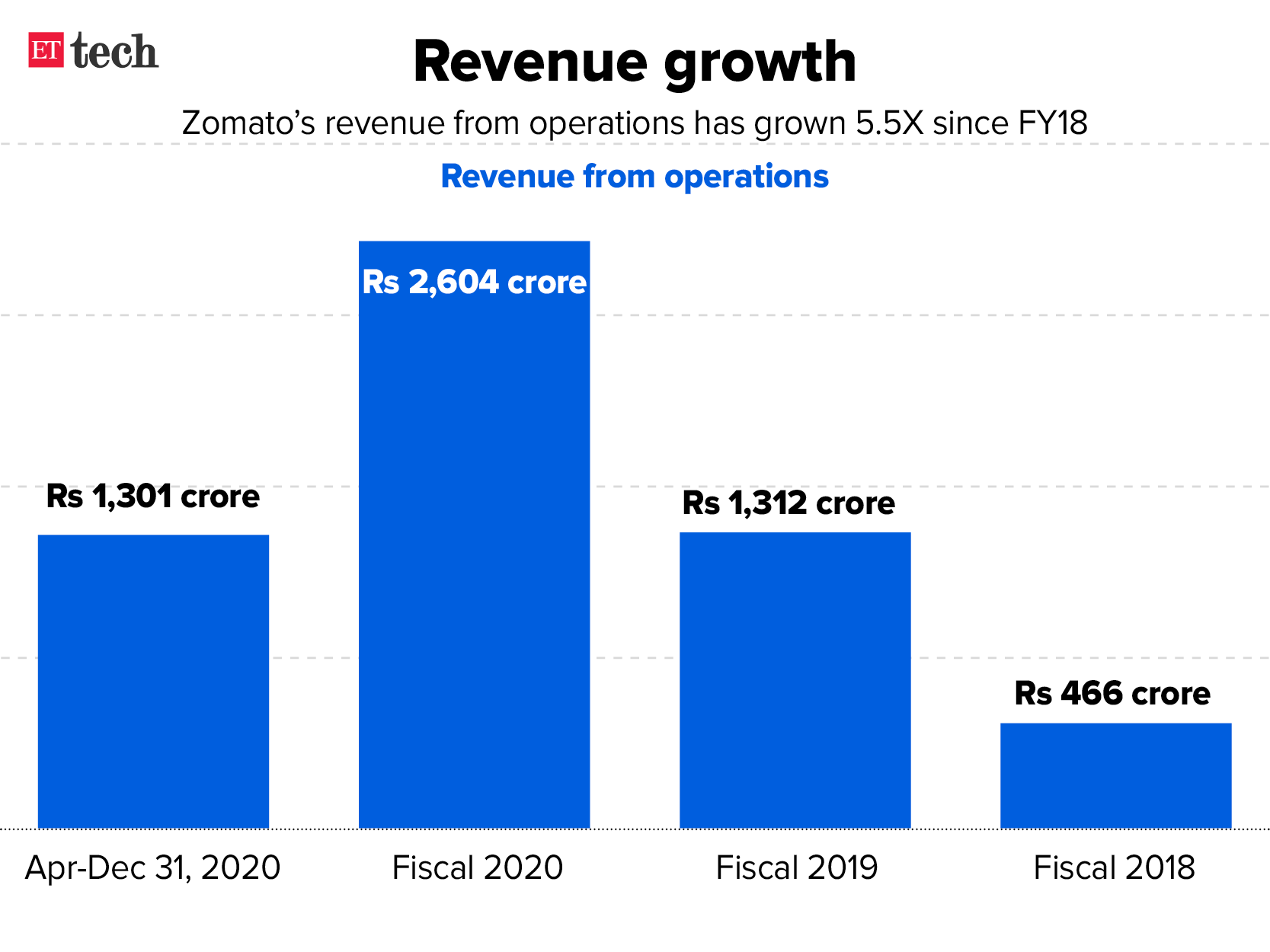

Food delivery firm Zomato filed for a historic $1.1 billion IPO with markets regulator Sebi on Wednesday. India’s startup ecosystem will be keenly watching how this offering unfolds as it could set the tone for the upcoming tech IPO rush. The public issue will also likely be a test of Indian investors’ appetite for startup unicorns in the country.

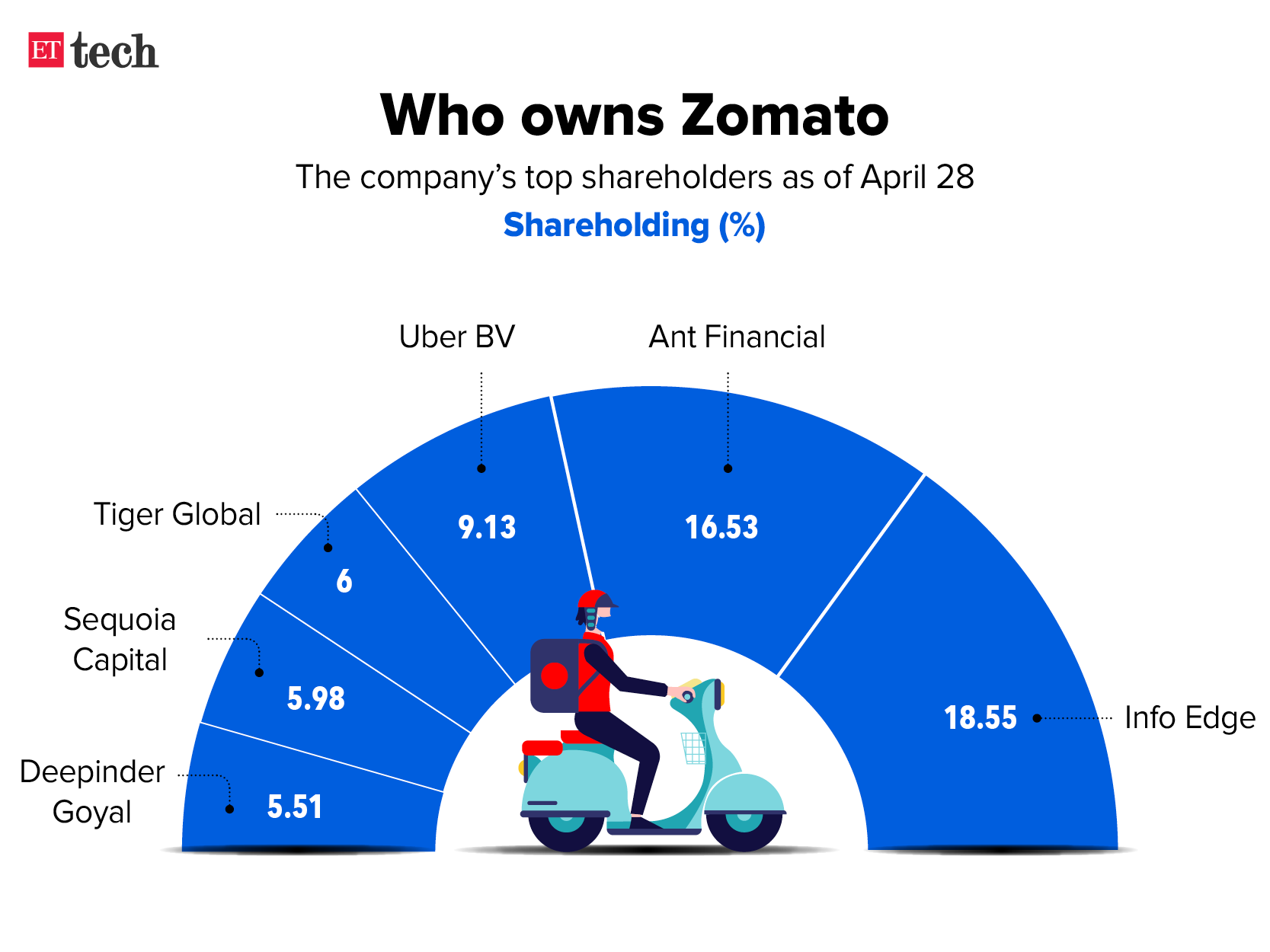

Investors in Zomato, including Info Edge, Sequoia and Ant Financial, are expected to reap massive returns if the food-delivery firm is able to garner the expected valuations. Do read our deep dive into Zomato’s IPO prospectus.

The stage is also set for a fierce battle of giants in India’s fast-growing online grocery segment after Tata Sons’ proposal to buy a majority stake in Alibaba-backed BigBasketgot the go-ahead from India’s competition watchdog, the Competition Commission of India (CCI).

The deal, which marks one of the largest M&A deals in India’s digital sector, will put Tata Group in direct competition with Reliance’s JioMart, Amazon and Walmart-owned Flipkart, apart from Grofers.

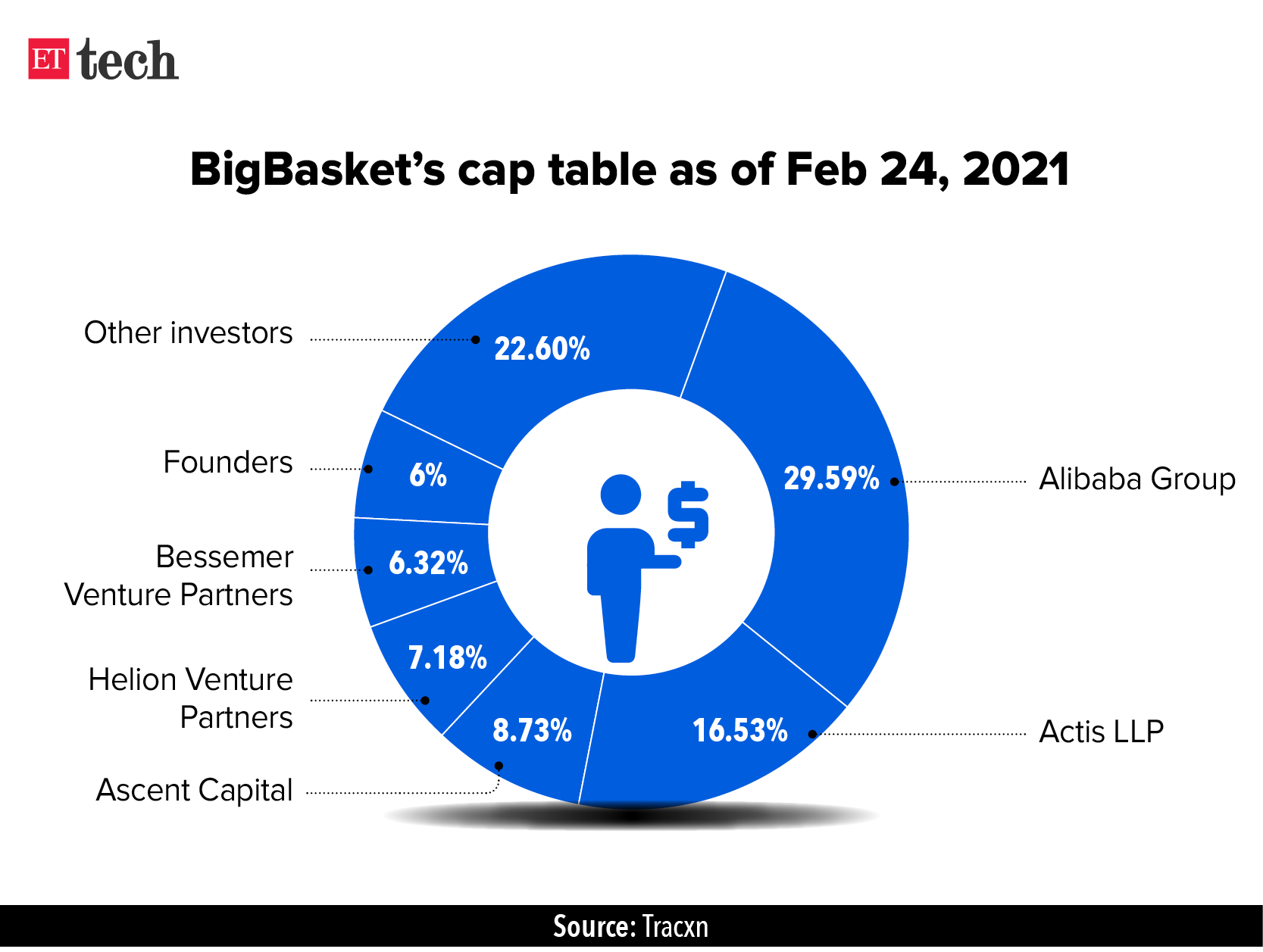

Tata Digital is likely to provide a full exit to two of BigBasket’s biggest investors — Chinese e-commerce giant Alibaba, which holds a 29.59% stake, and Actis LLP, which acquired several portfolios of scandal-hit Abraaj Group and owns a 16.53% stake in BigBasket. Some smaller investors in the e-grocer are also expected to get an exit. BigBasket counts Ascent Capital, Helion Venture Partners and Bessemer Venture Partners among its investors.

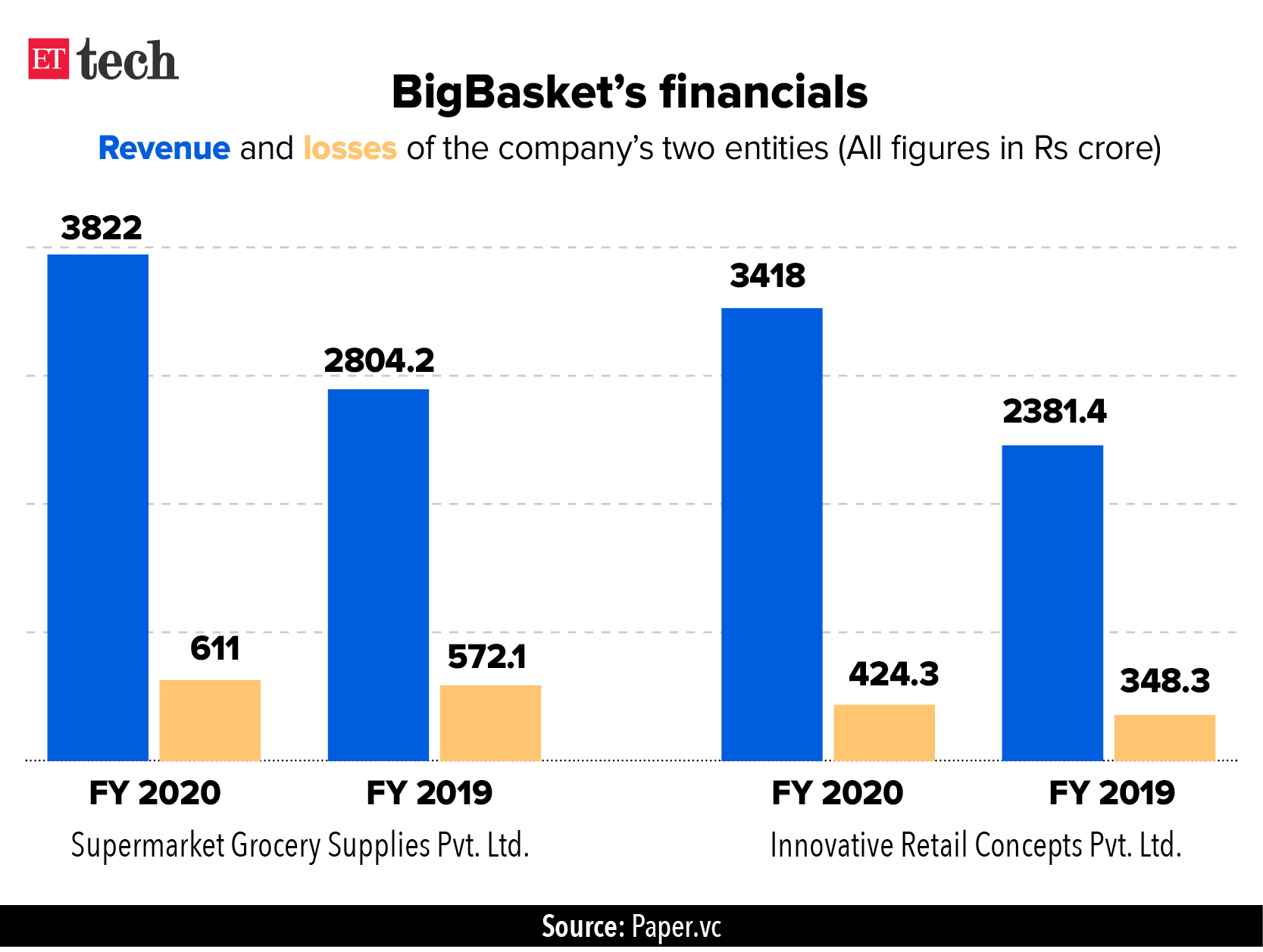

BigBasket is currently the leader in the online grocery segment and says it has crossed the $1 billion annual revenue run rate mark in September last year, buoyed by growing demand for online groceries due to the Covid-19 pandemic. Do read our explainer on the Tata Group-BigBasket deal.

STARTUPS, BIG TECH AID COVID RELIEF EFFORTS

Several startup entrepreneurs, investors and startup collectives have come together to mobilise resources and offer all kinds of assistance to help the country fight the second wave of Covid-19 which had ravaged Indian cities.

Large US tech companies like Google, Microsoft, Amazon, Apple, Salesforce, and retail giant Walmart are also extending their support to the country through donations, sourcing medical equipments like ICU ventilator units and oxygen concentrators, and medical supplies among others.

Meanwhile, India’s nodal platform to schedule appointments for Covid-19 vaccinations CoWin suffered initial outages on Wednesday evening as millions attempted to log in with the portal opening registration for all adult Indians. It further drew criticism as even those who managed to register soon discovered there were no appointments available for people below 45 years, despite them being eligible for the vaccine from May 1.

DEALS IN THE WORKS

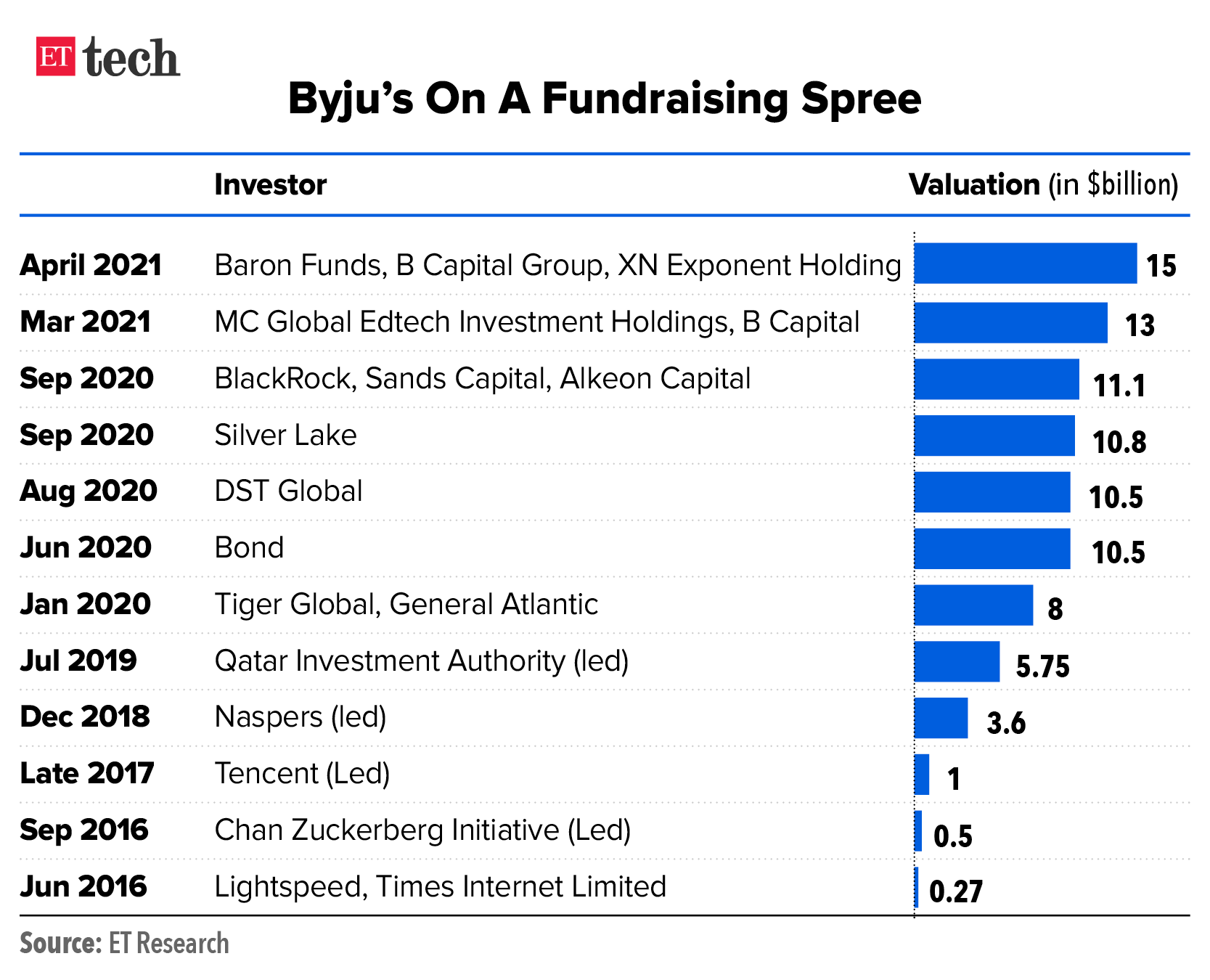

- Educational technology startup Byju’s is raising about $150 million from Swiss multinational investment bank UBS Group AG, at a valuation of around $16.5 billion, according to a source close to the development. The investment will catapult the Bengaluru-based firm as India’s most valuable startup, ahead of digital payments giant Paytm, which is currently valued at $16 billion.

- Omnichannel children’s retailer Firstcry will launch India’s largest Thrasio-style investment venture with $75 million in capital commitment from investors such as Japan’s SoftBank, TPG, ChrysCapital and Premji Invest, sources said. GlobalBees will buy, consolidate and fast-track the growth of brands that sell products on e-commerce marketplaces in India.

- Blackstone Group is making a $2.8 billion commitment to buy up to 75% of Mphasis, as cloud migration and demand for digital services surge during the ongoing Covid-19 pandemic. The private equity fund will be joined by a consortium of its limited partners, sovereign funds and marque US endowments like Abu Dhabi Investment Authority GIC of Singapore and UC Investments (The Regents of University of California) as co-investors.

- Tiger Global-backed GreyOrange is evaluating a US listing to raise $500-600 million, that could value the startup at $1.5-1.7 billion, people aware of the plan told ET. GreyOrange is currently in early-stage discussions with investment banks JPMorgan, Bank of America and Morgan Stanley for the capital raising initiative.

- Online business-to-business marketplace Udaan will buy back employee stocks worth Rs 165-175 crore, joining a batch of Indian startups that have facilitated such liquidity programmes for their staff amid the Covid-19 pandemic. Udaan joins a slew of startups such as Cred, Swiggy, Razorpay, Acko, Zerodha, MPL, Unacademy and Cars24 among others that have announced Esop buybacks in recent months.

OTHER BIG STORIES BY OUR REPORTERSFrom cybersecurity to business-to-business sales and mid-sized startups, companies across sectors have informed B-school placement cells that the internships are on hold or that they would not pay stipends, at least a dozen MBA students told ET.At the core of this battle is the disrupted supplies of graphics processing units (GPUs), due to a global shortage of semiconductor chips and a surge in demand from both gamers and miners, who are now accusing each other of hoarding them.Sebi accepted the recommendation of Ministry of Corporate Affairs that institutional holding threshold should be 50%, after initially proposing a lower threshold of 40%.Several leading brands have replaced upfront brand promotions to escalate Covid-19 protocols in advertising on their social media handles, driven by the need to post sensitive content at a time when the second wave of infections is raging across the country.Indian technology services companies, including Wipro and Infosys, are ramping up their large deal teams to remain competitive and keep an eye out for big and long-term contracts over the next few years.

That’s about it from us this week. Have a great weekend!